From a strategy and organizational perspective, JPM is well known for their “preference” to develop applications internally. Chase was very late to the money movement game, rolling out its first QuickPay service in 2008 (whereas Bank of America and Citi have been providing this since 2002 through CashEdge).

#DOES CHASE QUICKPAY COST MONEY REGISTRATION#

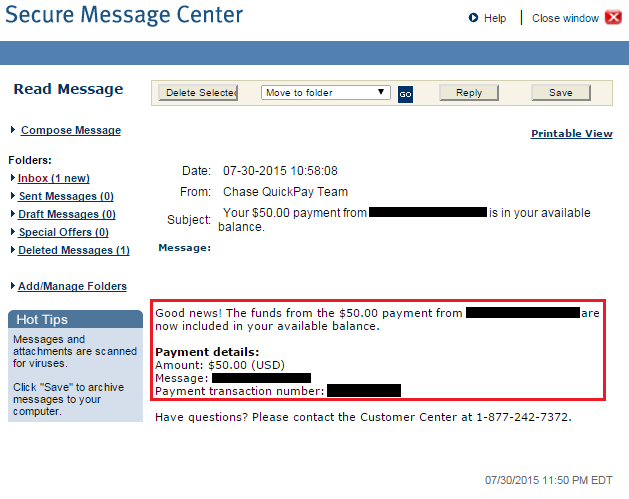

QuickPay is a JPM’s money movement “pay anyone” service that provides registration for both Chase and non Chase customers. This month the JPM retail team has delivered new capability in its iPhone versions of QuickPay and Quick Deposit products. This innovation has been “in the works” over the last few years, and Jack Stephenson (PayPal’s former head of strategy) is fortunate to have joined at a time where both the payment platform and team is gaining traction. Previous post on USAA’s American BankerĬhase has a stellar eCommerce and mobile team in both their retail and cards organization, and they are poised to deliver tremendous payment innovation across both of these business units.If your intended recipient has a PayPal.Me link, go to the link and enter the money transfer amount. The funds go into that person's PayPal account. You can do this through the website or app. When you're ready to send money, simply enter the mobile phone number or email address of the person to whom you're indebted and specify the amount to send.

You fund your PayPal balance through your bank account or with a credit or debit card.

#DOES CHASE QUICKPAY COST MONEY FOR FREE#

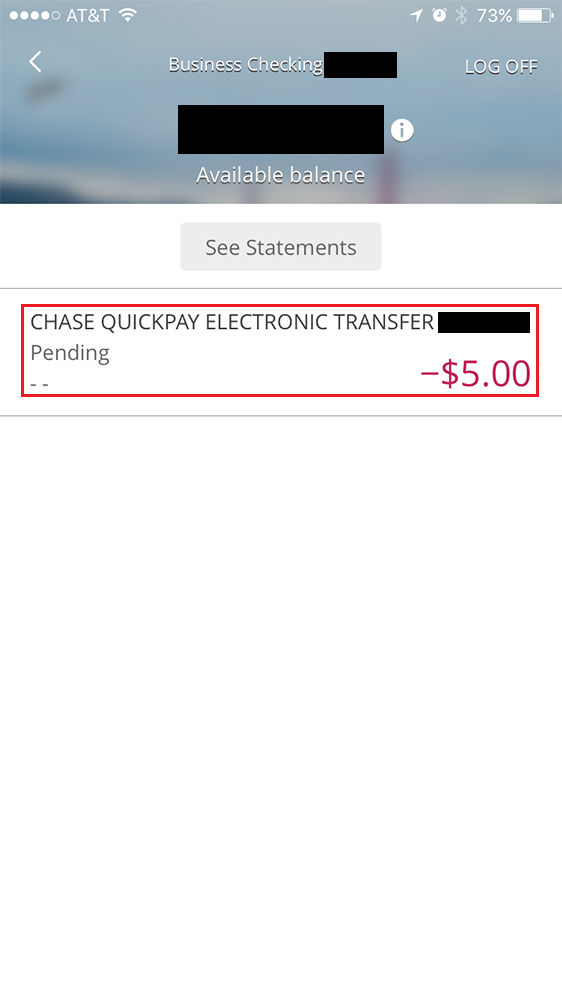

Recipients provide their bank account information, and the money is safely deposited within three days.Ī personal PayPal account lets you transfer money for free into another person's account. They're notified via text or email that you're transferring money to them. Recipients don't need a Popmoney account to accept payment. Otherwise, it's only 95 cents if you initiate the transfer. You can send money for free if a Popmoney user sends you a request. Bank, Bank of America, Citibank, PNC Bank, SunTrust Bank and Wells Fargo. Popmoney offers one of the easiest ways to send money via mobile devices or email if you have an account at a participating bank - Ally Bank, TD Bank, Fifth Third Bank, Regions Bank, U.S. If your or your recipient's bank doesn't offer Zelle, you can still send or receive money through the service by registering at. Bank and Wells Fargo are among the financial institutions offering this service. Ally Bank, Bank of America, Capital One, Chase Bank, U.S. Zelle is a newer offering, but more and more banks are joining. No account information is shared when you send money the program will only use your email or mobile phone number to send or receive money to or from your bank account. With Zelle, users just need a mobile phone number or an email address to send money to their intended recipient. account in which to receive the bank transfer.Ĭhase sets limits on transferring money depending on the type of transfer and whether the recipient has a Chase Bank account.Īccount holders at banks that are part of the clearXchange network can take advantage of the new Zelle app, which allows you to securely send money to others by using your bank's mobile app. Recipients don't have to be Chase Bank customers to receive a money transfer through this service however, they must create a log-in via verify their email address, and add a non-Chase U.S. For simple money transfers, Venmo lets you use a funding source such as a bank account or money you've received from others through the app.

Venmo, which is owned by PayPal, also has a social function so you can share your transfer history with friends. Money transfer apps such as Venmo let you send money and perform other functions, such as making payments at participating businesses, with your phone.

You cannot use the service outside the U.S. The free service has a limit of $250 per week, which increases to $2,500 in most states if you verify your identity with your name, date of birth and the last four digits of your Social Security number. Other ways to send money through Square Cash include the Cash app, iMessage and Siri. If you have your own Square Cash account, sign in, enter the amount to send and click "Pay." If you don't have an account, select the "Pay" option and follow the prompts. If your recipient has a Square Cash account, ask for his personal Cashtag URL and visit the page. Square Cash uses a simple system of "Cashtags" to do money transfers. Here are six ways to send money to your friends and family without incurring fees: Whether you're paying your share of rent or a dinner check, making a quick payment has never been easier.

0 kommentar(er)

0 kommentar(er)